Introduction

In December, as part of the advent series, we organized a Q&A session, where our experts, Maria Farkas and Robert Szücs-Winkler discussed various critical topics concerning ESG reporting, the Corporate Sustainability Reporting Directive (CSRD), and its implementation within organizations. These inquiries shed light on the challenges, strategies, and essential aspects involved in aligning with these sustainability reporting frameworks.

What is the role of the ESG reporting team in the sustainbale management of the organisation? What should be the place and role?

ESG reporting personnel play a crucial role in an organization’s sustainable governance, yet it’s a challenge for many companies to establish this function effectively.

Having a designated responsible individual (such as the risk manager in Hungary) or a team is essential. This person should maintain a direct connection with upper management and the CEO. However, it’s essential to recognize that the sustainability person cannot manage everything single-handedly. Their role primarily involves catalyzing efforts, acting as a communicator, gathering diverse information, challenging departments, setting targets based on collective input, and presenting these to management. This aids in ensuring that management comprehends the ongoing progress, aligns with stakeholder expectations, and identifies where improvements are necessary.

Additionally, the CEO’s digital signature might be required as part of compliance.

If we already have a lot of data in place, how to start with ESG report?

Firstly, it’s crucial to grasp the requirements, especially the mandatory standards like ESRS 2, as they define the framework for ESG reporting. Understanding ESRS 2 provides a foundational understanding of other standards, aiding in structuring the reporting journey, setting targets, and planning actions. This step is particularly beneficial for those already familiar with sustainability practices, making it easier to digest and apply.

Secondly, finding suitable partners to conduct a double materiality assessment is imperative. Identifying materiality topics specific to the organization is key as it informs the selection of standards to meet. This assessment, focusing on what matters most to the company (such as waste management, biodiversity, climate impact), is essential for strategic alignment.

Thirdly, once the materiality topics are understood, delving deeper into relevant legislation and standards related to these areas becomes crucial. The subsequent step involves conducting a gap analysis to identify any missing elements within the existing data or reporting structure. Tools like EFRAG can offer substantial assistance, aiding in comparing requirements from different reporting standards (like GRI and CSR). Although the tool might still be in the draft stage, leveraging it can provide valuable insights.

Lastly, after identifying the data within the system, it’s important to pinpoint data owners, address any missing information, and ensure data is in the right format or department. ESRS 2 can then be used to compare this data with previous reporting, allowing for a comprehensive overview of progress and areas needing improvement in ESG reporting.

How to automate the scope from real estate owners?

Automating Scope 3 emissions from real estate owners is a multifaceted task. Initially mandated by CSRD, Scope 3 emissions represent a significant portion, approximately 70%, of an organization’s climate impact assessment. However, obtaining this data from real estate landlords, particularly when they provide utilities indirectly, requires a comprehensive evaluation of reporting boundaries, emission scopes, and building infrastructure. Choosing a consistent reporting methodology becomes pivotal in this process.

Automation tools, including sensors and communication systems, offer a pathway to streamline data collection. Additionally, in certain regions, electricity providers extend APIs, simplifying integration with organizational systems and facilitating a more efficient data retrieval process.

How to use the ESRS standards?

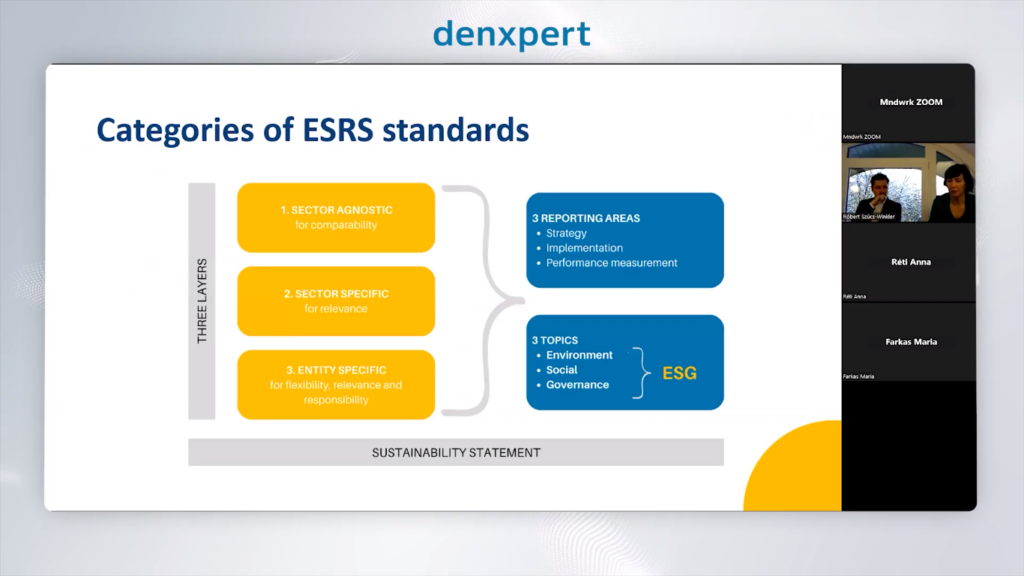

ESRS standards serve as a structured framework with various layers, including sector-agnostic, sector-specific, and entry-specific components. These standards encompass three core reporting areas: strategy, implementation, and performance measurement, revolving around ESG themes.

Starting with ESRS 1, which establishes the foundational definitions and background of the CSRD, and ESRS 2, mandatory for all, these standards are pivotal. Additionally, sector-specific standards are under development, with workshops by EFRAG refining these elements.

Each ESRS standard covers governance, strategy, impact, risk and opportunity, metrics, and targets. Presently, companies predominantly report on metrics, leveraging the detailed ESRS data points available on their website. Meeting these standards entails detailing policies, decisions on materiality topics, planned actions for sustainability, and outlining metrics and targets.

What are the stricter requriements in the Hungarian new ESG law draft compared to the general EU CSRD?

The Hungarian draft of the new ESG law follows a similar structure to the EU CSRD directive and ESRS. However, it introduces stricter requirements, notably in risk assessment. Companies must submit an annual risk assessment report to their board by June and designate a responsible individual for risk management. Additionally, there’s a strong emphasis on supplier accountability; if a CSR incident occurs within the supply chain, companies must promptly collaborate with the supplier to resolve the issue. Failure to resolve it within 90 days necessitates a joint remedial plan. If the supplier continues the breach, cooperation must cease within three months.

Reporting under this law requires the use of Hungarian language and a dedicated Hungarian electronic platform. The choice of reporting location is crucial; global or international footprints must be reported in Hungarian. Accreditation for auditors, consultants, and software is mandated, posing an initial challenge due to limited certified professionals.

How is the scaling of each category in the double materiality assesment defined?

Scaling in the double materiality assessment involves evaluating the severity of negative impacts or the benefits of positive impacts on people or the environment. This scale is outlined in ESRS 1, focusing on both negative and positive impacts. Implementing this terminology in the assessment poses challenges.

The main hurdle in double materiality lies in engaging stakeholders. Conducting a two-phase workshop is recommended: first, gather information from stakeholders, and then internally discuss and position the obtained information.

Involving numerous internal stakeholders strengthens the assessment, albeit it’s time-consuming. The absence of industry standards and guidelines, along with potential disparities in local regulations, complicates the process.

How can companies integrate their risk asssesment and impact into one comprehensive framework in alignment with the CSRD regulation?

Companies aligning risk assessment and impact within a comprehensive framework as per CSRD regulation can refer to ESRS 2, Chapter 4, which details the reporting process. This description serves as a core requirement guiding the integration and aids in understanding the steps essential for the double materiality assessment.

Distinguishing between financial and impact risks and opportunities poses challenges; clients often find it challenging to differentiate impact materiality from financial materiality. CSRD operates as a management system framework rather than a reporting framework. Although policies, actions, and targets are established for each indicator, this system is dynamic and necessitates ongoing management.

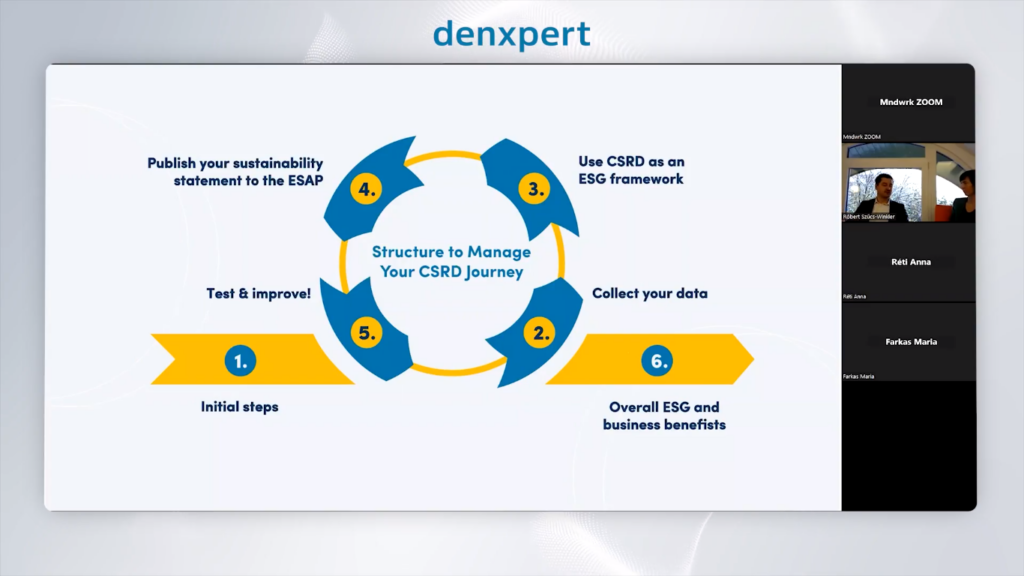

Managing targets within a fixed system presents complexities. A structured approach consisting of six steps is recommended: initial steps involving gap analysis, double materiality assessment, and partnership identification; data collection through ESRS 2; comprehensively describing CSRD as an ESG framework; reporting to ESAP (starting 2027); continuous testing and enhancement of the management system; ultimately leading to the recognition of the system’s benefits.

How should social activities be designed and organised to support employee retention?

The CSR Directive (CSRD) doesn’t prescribe specific actions for supporting employee retention; it primarily focuses on financial aspects. CSRD lacks indicators that label actions as “good” or “bad” concerning employee retention. Instead, it assumes that publicly available information will influence stakeholders and investors to demand the highest standards. High employee turnover, say 30-40%, indicates a problem that needs addressing. Defining retention targets aids in identifying areas needing improvement, such as health and safety, equal rights, and opportunities, fostering an environment conducive to employee retention. Understanding reasons behind high turnover and gathering feedback helps identify weaknesses. While CSRD serves as a reporting framework, it doesn’t provide direct action guidelines; however, meeting legal requirements remains fundamental.

What is the place of ESRS for biodiversity ecosystems in the CSRD reports?

ESRS 4 plays a pivotal role in CSRD reports by focusing on understanding a company’s impact on biodiversity and ecosystems. Its primary objective involves aligning actions and strategies with prominent frameworks such as the EU biodiversity strategy, biodiversity framework, and the EU birds and habitat directive. Companies must evaluate if biodiversity holds material significance, and if so, develop transition plans to harmonize their strategies and business models with biodiversity and ecosystem requirements. Establishing a dedicated team within the organization, equipped with expertise in biodiversity, is essential. External experts can also support in formulating policies, actions, and setting targets with measurable metrics. While recent changes have rendered ESRS 4 more flexible and voluntary, biodiversity is anticipated to become a crucial consideration for many companies, making compliance with these standards increasingly significant.

The scope of where your reporting, how you reporting?

Under CSRD guidelines, companies must decide whether subsidiary entities report separately or if reporting occurs centrally through the headquarters. Regardless of the approach chosen, the level of detail in the report remains the same. However, accountability for reporting quality lies with the headquarters. For European companies, deciding on reporting methods is critical; there is no option to selectively include or exclude certain subsidiary companies. The CSRD mandates using ESRS as the reporting structure.

For a global enterprise with subsidiaries across multiple countries, the CSRD requires all subsidiaries to report collectively with the headquarters. It’s vital to establish a reporting structure early on, potentially adopting a global reporting initiative (GRI) framework, even for non-EU companies. Starting this process early is crucial, as initial reporting rounds may have data quality issues. Recognizing errors and starting preparatory steps in advance can help streamline reporting in subsequent years, especially considering the CSRD’s allowances for errors.

Summary

Navigating the complexities of ESG reporting involves multifaceted approaches, from harnessing existing data to aligning with stringent regulatory requirements. The ESG reporting function, led by designated individuals or teams, serves as a catalyst for sustainable governance. Starting the ESG reporting journey entails understanding mandatory standards like ESRS 2, conducting materiality assessments, and ensuring compliance with new legal drafts like the Hungarian ESG law, which introduces more rigorous risk assessment and reporting requirements. Integrating biodiversity considerations through ESRS 4 and managing reporting structures aligns with the CSRD’s guidelines. ESG reporting’s success hinges on strategic planning, data integration, and adaptation to evolving standards, culminating in transparent, comprehensive, and impactful sustainability reporting.

If you have any further questions about the CSRD or ESG reporting, please don’t hesitate to contact us!