Over the past decade, ESG has gone from the niche to the mainstream. Investors and companies have seen increased regulations, transparency requirements, and a proliferation of standards. They recognized that ESG rating is a tool to supply valuable investment information and measure progress facing challenges like climate change.

Measurement is essential, as the already obvious impacts of climate change dominate investment concerns. Transitioning to a net zero economy can affect all financial assets, from public equities to private debts. As investors incorporate these facts into their decision-making, several important questions are still unanswered: What emerging issues today could become systemic risk tomorrow? To find out, explore a selection of key ESG trends to watch for in 2022 and 2023.

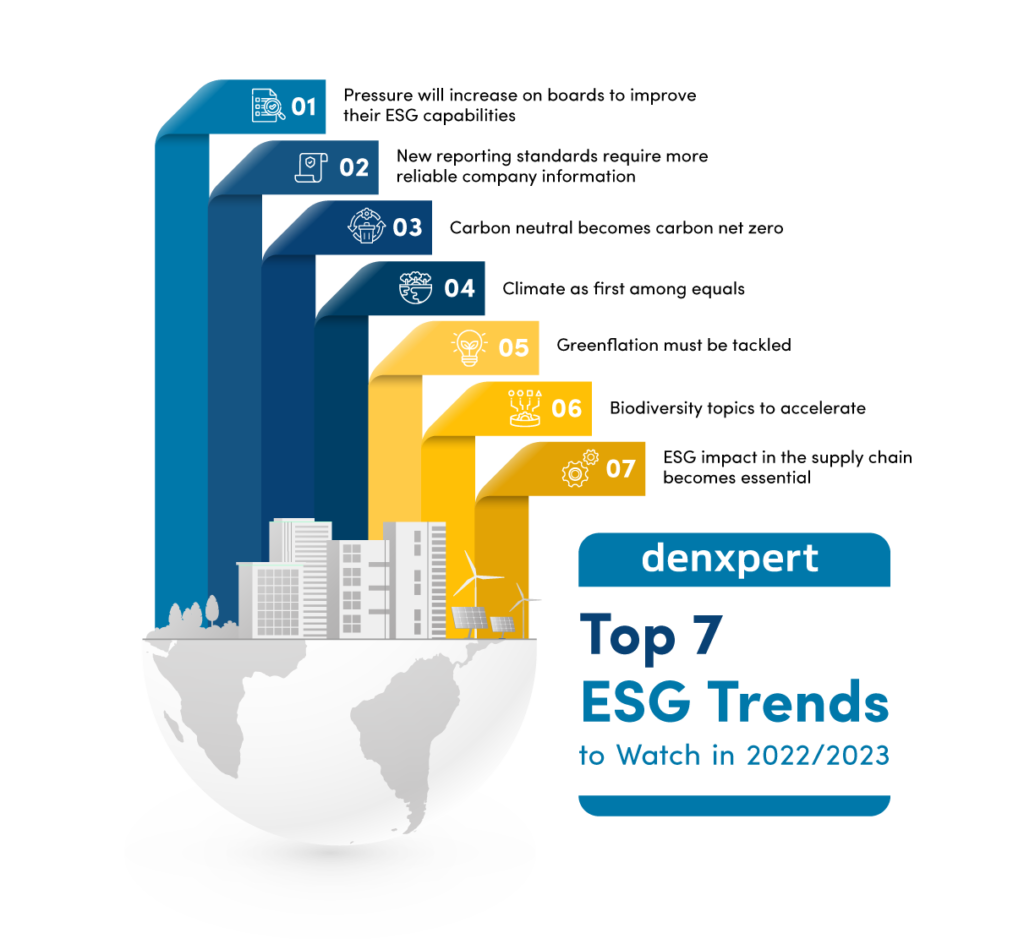

1. Pressure will increase on boards to improve their ESG capabilities

In 2022, boards and government leaders face increasing pressure to prove that they are up-to-date in understanding and overseeing ESG issues – from transformative climate to human rights and social unrest. The expanded scope of boards’ responsibilities also requires a more significant commitment of focus and time from board members to fulfill their fiduciary duties. Pressure on boards to bolster their ESG credentials will increase as investors demand greater accountability from executives and increased attention to sustainability.

2. New reporting standards require more reliable company information

As more corporations set sustainability goals and release ESG-related data in 2021, investors, regulators, and the public increasingly investigate corporate sustainability efforts, calling out what they perceive as “greenwashing.” This skepticism is based on concerns that companies are using sustainability-related information and product labels as a marketing tool to appear more proactive than they actually are.

New global standards related to ESG will continue to evolve in the following years. Global standards bodies such as the new International Sustainability Standards Board will help overcome the biggest challenge to accountability: the lack of a common baseline for reporting standards consistent across authorities and industries.

3. Carbon neutral becomes carbon net zero

While many companies have made considerable progress toward reducing their carbon footprint, scientists and environmental experts agree that these efforts will not be enough to avoid future climate disasters. Actions should be increased to reverse the amount of carbon in the atmosphere or reduce it to the lowest possible level. Companies committed to net zero carbon need to make more significant steps in reducing (or eliminating) carbon in their operations and supply chains, using offsets only as a last resort.

4. Climate as first among equals

Climate overshadows governance and social issues at the top of the ESG agenda, reflecting both the existential threat of rising global temperature and the race with time to restrain it. There will be an enormous need for projects that help us adapt to a changing climate. Governments and multinational corporations issue bonds to pay for them, which can lead to a massive expansion of the green bond market.

As the world’s largest companies strive to reach net zero, pressure to reduce greenhouse gas (GHG) emissions can become as familiar to suppliers as pressure on keeping their pricing low. If the goal is a net zero portfolio, divestment seems to be the path of least resistance, especially for coal. But that is unlikely to move the needle to achieving a net zero economy. To do this, investors will likely seek to expand their toolbox: participating where they can leverage, divesting where they cannot, and engaging in policy discussions to change the context.

5. “Greenflation” must be tackled

While companies must carefully watch all these regulatory initiatives, the macroeconomic environment will be the most challenging in promoting ESG transition in 2022. Indeed, companies will face rising energy, carbon and commodity prices for longer than initially expected, as many recent articles state that high energy prices will stay with us for years. Coupled with the growing need to invest in decarbonization technology, this trend leads to “green inflation”; in other words, structural (long-term) inflationary pressure caused by the greening of the economy.

6. Biodiversity topics to accelerate

The next trend that companies should include on their ESG agenda is the growing importance of biodiversity issues. Addressing the climate crisis and preserving natural capital are two sides of the same coin. A sustainable economy depends on an adequate amount of natural capital and low carbon emissions. Hopefully, the measurement of natural capital will eventually succeed in 2022.

Taskforce on Nature-related Financial Disclosures (TNFD) has begun work on the reporting framework, with a beta to be released early this year. The framework “will provide companies and investors with decision-useful information to help shift the flow of global capital to nature-positive outcomes,” tells the TNFD website launched in June 2021 and endorsed by the G7 finance ministers.

7. ESG impact in the supply chain becomes essential

Supply chains are crucial in transitioning to a net zero economy, as up to 90% of an organization’s environmental impact lies within its value chain – either upstream (in the supply chain) or downstream (e.g., the product use phase). In 2021, companies became acutely aware of the dependence and fragility of their supply chains. In 2022, this trend will continue as the global economy recovers from the pandemic and management teams focus on rising supply chain costs and disruption risks.

The growing pressure on companies to track Scope 3 emissions and decarbonize their supply chains will continue. The value chains of global retailers and original equipment manufacturers (OEMs) are particularly scrutinized, prompting companies to look for green products, such as green steel or aluminum.

At the same time, social and governance factors in the value chain will move into the spotlight. While the EU is still developing due diligence legislation to improve ESG performance in the value chain, the German supply chain law (“Lieferkettengesetz“) will come into force in 2023 for companies with more than 3,000 employees.

Conclusion

How companies can evolve their ESG strategies to respond to these enormous challenges will decide which firms are considered leaders in this field rather than followers or laggards. The bar continues to be raised every year, and businesses will need to improve rather than rely on past promises and commitments. The leaders of these organizations will need to continually promote their thinking as they move their companies forward in the new normal.

Check out our e-book to find out how to achieve a successful ESG report!